Like the amen in church, financing is part of investment real estate

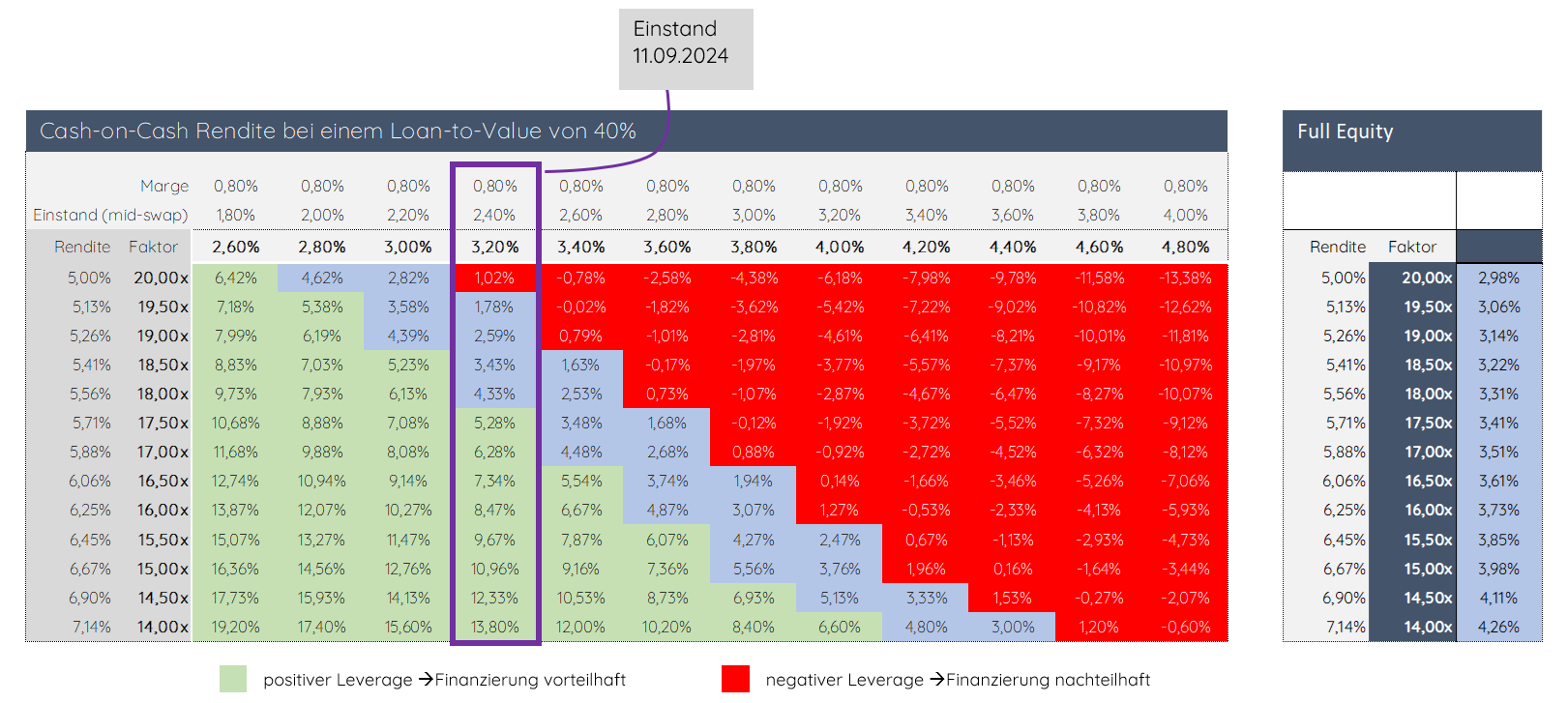

As long as the return after costs is higher than the interest costs, the return on equity can be leveraged (Leverage Effect). Now the interest accrued since 03/2022 literally exploded, am 11.09.2024 was the debut with a view to the last 10 Years still at a high level. There has been an adjustment in prices in recent times 24 took place slowly for months, the economist speaks of elasticity.

Our presentation is based on fixed assumptions and does not represent a concrete analysis, but shows, that it continues to be difficult for real estate investors at the current price- and interest rates to achieve attractive returns

Purchase factor up to 20x in positive leverage

The analysis shows, that up to a purchase factor of approx. 20-small (5,0 % Purchase return) – in the current interest rate environment – borrowing is advantageous. The exact amount depends, among other things, on the individual costs and expenses of the investment. In addition, when considering risk – as with any leveraged investment – the volatility and stability of the cash flow should be assessed and taken into account.

The number of real estate financings has fallen significantly in the last two years. We recently discovered, that the financiers have increased their risk margin. In addition, reference points from the market environment are missing, what leads to this, that the margins in the term sheets of the different financing providers show a wide variance. We are countering this with a comprehensive tender for financing (Tender procedure). Especially alternative financiers, like debt funds in senior- and junior loan segment, who had a hard time during the low interest rate phase, can now submit competitive and attractive offers.