In the year 2025 Interest rates for commercial real estate financing in Germany have settled at a comparatively high level. In particular, the uncertainties surrounding French public finances and the stability of the euro have contributed to a noticeable increase in the price of the entire sector. Both investors and portfolio holders are faced with higher financing costs, which strongly influence the planning and profitability of projects.

Current interest rates and market developments

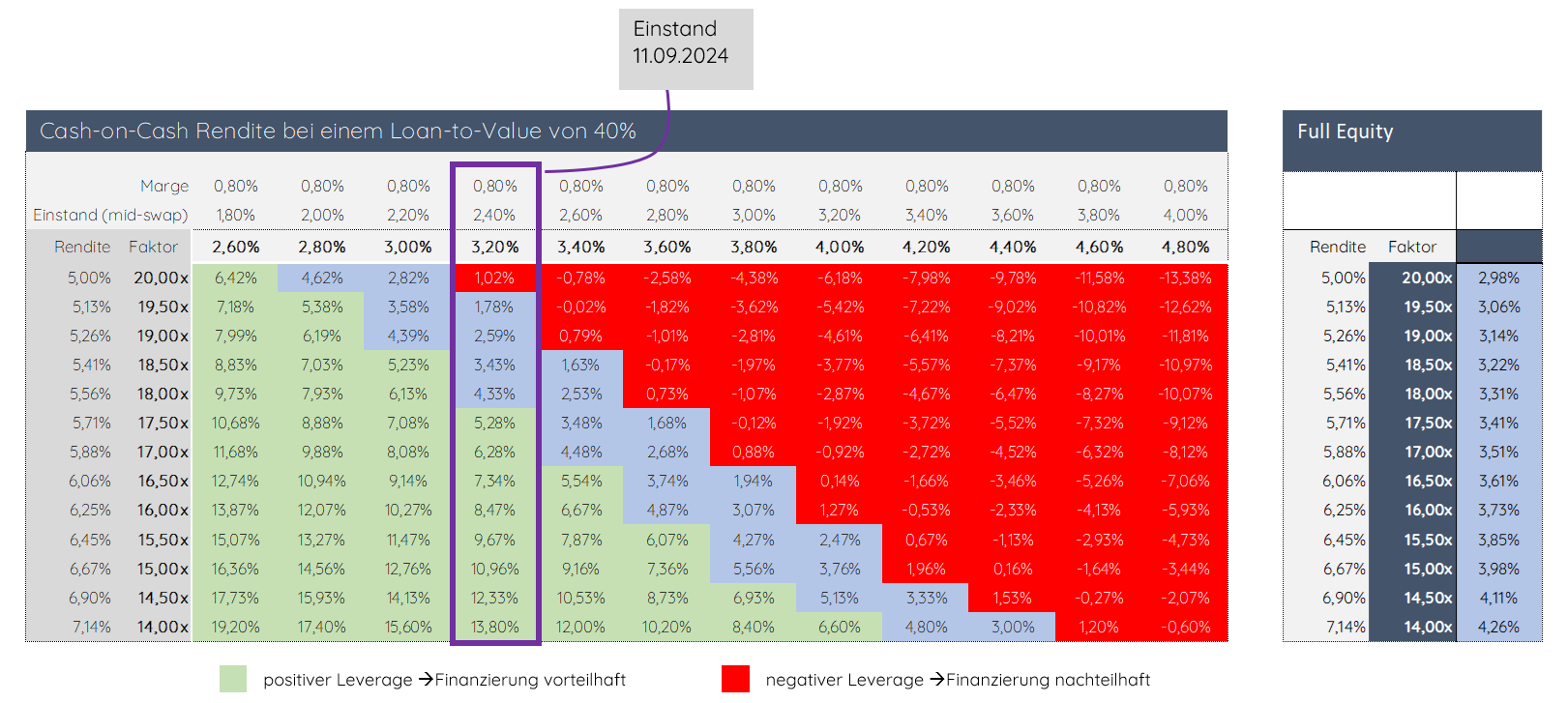

The effective interest rates for standard properties in the area of commercial real estate financing were in the summer 2025 average between 3,7 % and 4.5%. These values apply to classic new construction projects as well as to existing properties and refinances.

For longer fixed interest rates of 10 years or more the banks often demand additional surcharges, especially when it comes to properties with a higher risk rating or the terms of the loans are relatively short.

company, who need to refinance existing loans, are facing a particularly high burden: Interest rates have almost decreased compared to previous years doubled, which significantly reduces the profitability of projects and presents many portfolio holders with strategic challenges.

Influence of France and Euro stability

A central driver of higher interest rates is the Debt crisis in France. The increased risk of French government bonds has put financial strain on the entire eurozone. Banks are reacting to this uncertainty:

-

Tighter lending

-

More intensive risk assessment

-

Higher risk premiums and margins

The turbulence on the European bond market is leading to this, that higher interest rates are charged even for solid properties, as the institutions recalculate their default risks and try to hedge.

Impact on companies and investors

The current interest rate situation has several consequences for companies:

-

Barriers to investment: Higher financing costs make new construction projects more difficult, Renovations and modernizations of existing properties.

-

Declining profitability: Especially when it comes to refinancing, the almost doubled interest rate has a massive impact on profit margins.

-

Adapted financing strategies: Many companies are increasingly relying on flexible interest rates, Special repayment rights or alternative financing instruments such as Mezzanine-Kapital or international loans, to reduce the load.

In short: The combination of internal refinancing needs and external uncertainty in the Eurozone leads to it, that borrower in the year 2025 have to expect permanently higher interest rates and stricter lending standards. Commercial real estate financing has therefore become noticeably more expensive and risky.